Valuing your business

Although there are several formulas you can use, there are no black-and-white answers on valuation techniques.

It’s important to conduct your own research, then get independent advice from a business valuer or broker.

Here are four of the most commonly used valuation methods:

1. Asset valuation

2. Capitalised future earnings

3. Earnings multiple

4. Comparable sales

- Asset valuation method

• Adds the value of the assets of the business and subtracts its liabilities

• Determines what the business would be worth if it were closed down today and sold

• Doesn’t take into account the ability of those assets to generate wealth in the future

• Doesn’t take into account goodwill

• For these reasons, asset valuation may understate the true value of the business

- How it works

Add up the value of all the assets such as cash, stock, plant and equipment and receivables

• Add up liabilities, such as any bank debts and payments due

• Subtract the liabilities from the assets to get the net asset value

- Example

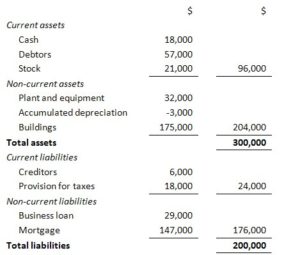

• Richard wants to buy a manufacturing business. Here’s an extract from the balance sheet:

• The business has $300,000 of assets and $200,000 of liabilities

• The net asset value is $100,000

- What about goodwill?

• Goodwill is the difference between the true value of a business and the value of its net assets

• It can be crucial to the value of retail and service-based businesses

• Asset valuation doesn’t include a value for goodwill, so may understate the true value of a business

• For example, if you value a hair salon, where service, location and reputation are important, the value of any goodwill would have to be added to net assets to get a valuation

• Goodwill may or may not be transferred if you buy a business, since it can come from physical features like location, or from personal factors, like the owner’s reputation or relationships with customers or suppliers

• If a business is underperforming and has no goodwill, then using net asset valuation could be an accurate way to value it

- Capitalised future earnings

• When you buy a business, you’re buying its assets and the right to all profits the business might generate

• Capitalising future earnings is the most common method used to value small businesses

• It considers the rate of return on investment (ROI) that you can expect to get from the business

- How it works

• Work out the average net profit of the business over the last three years using its profit-and-loss statements, adjusting profit for one-off expenses or other irregular items each year

• Decide on the annual rate of return you’re looking for (e.g. 20 per cent)

• There are no rules about the number you choose, except higher risk should give higher returns

• Compare the business with other investment opportunities

• You can also look at the rate of return that similar businesses in your industry achieve

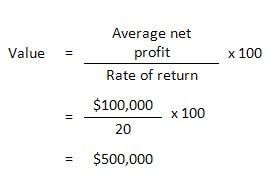

• Divide net profits by the rate of return to determine the value of the business, then multiply by 100

- Example

David is looking at buying a bakery business with average net profits of $100,000 per annum after adjustments. David wants an annual rate of return of 20 per cent. The capitalised earnings valuation is:

• David will pay $500,000 now for a business he believes will earn $100,000 a year plus 20 per cent more profit each year into the future

Earnings multiples’ earnings before interest and tax (EBIT) by your selected multiple

• For example, you might value the business at twice its annual earnings – so a business with an EBIT of $200,000 might be valued at $400,000

• The multiple you choose will depend on the industry and the growth potential of the business

• A service-based business might be valued at as little as one year’s earnings, while an established business with sustainable profits might sell for as much as six times earnings

- Comparable sales

• Whatever other valuation method you use, you should also look at prices for recent sales of similar businesses

• Research what’s happening in the market you’re interested in

• Speak to business brokers and gauge their feelings about the business’ value

• A broker may know what similar operations are selling for and how the market is placed

• Check business-for-sale listings in industry magazines, newspapers or websites